I was struggling paying my minimum debt payments and I signed up for Freedom Debt Relief back in October 2024 (yes, I regret it now)

Currently I have $26,840 enrolled debt with FDR

There were 5 accounts

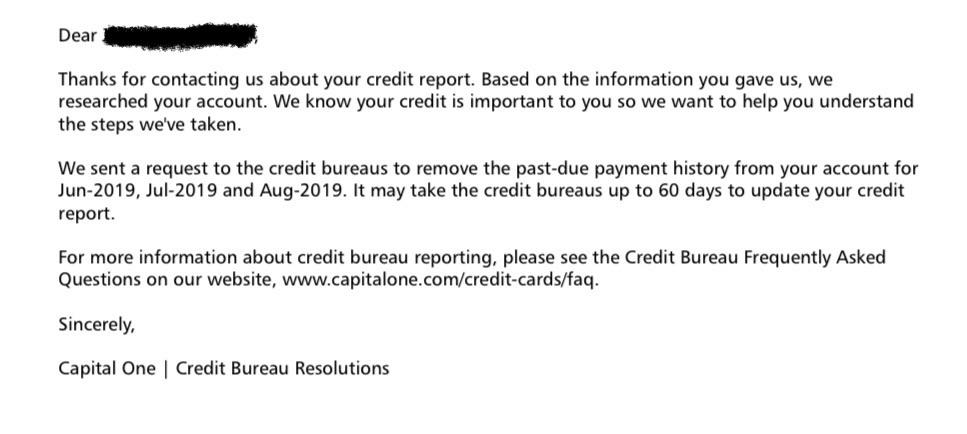

2 have been paid off (settled for less than owed)

2 I am currently repaying

2 waiting to be negotiated

1 currently being negotiated

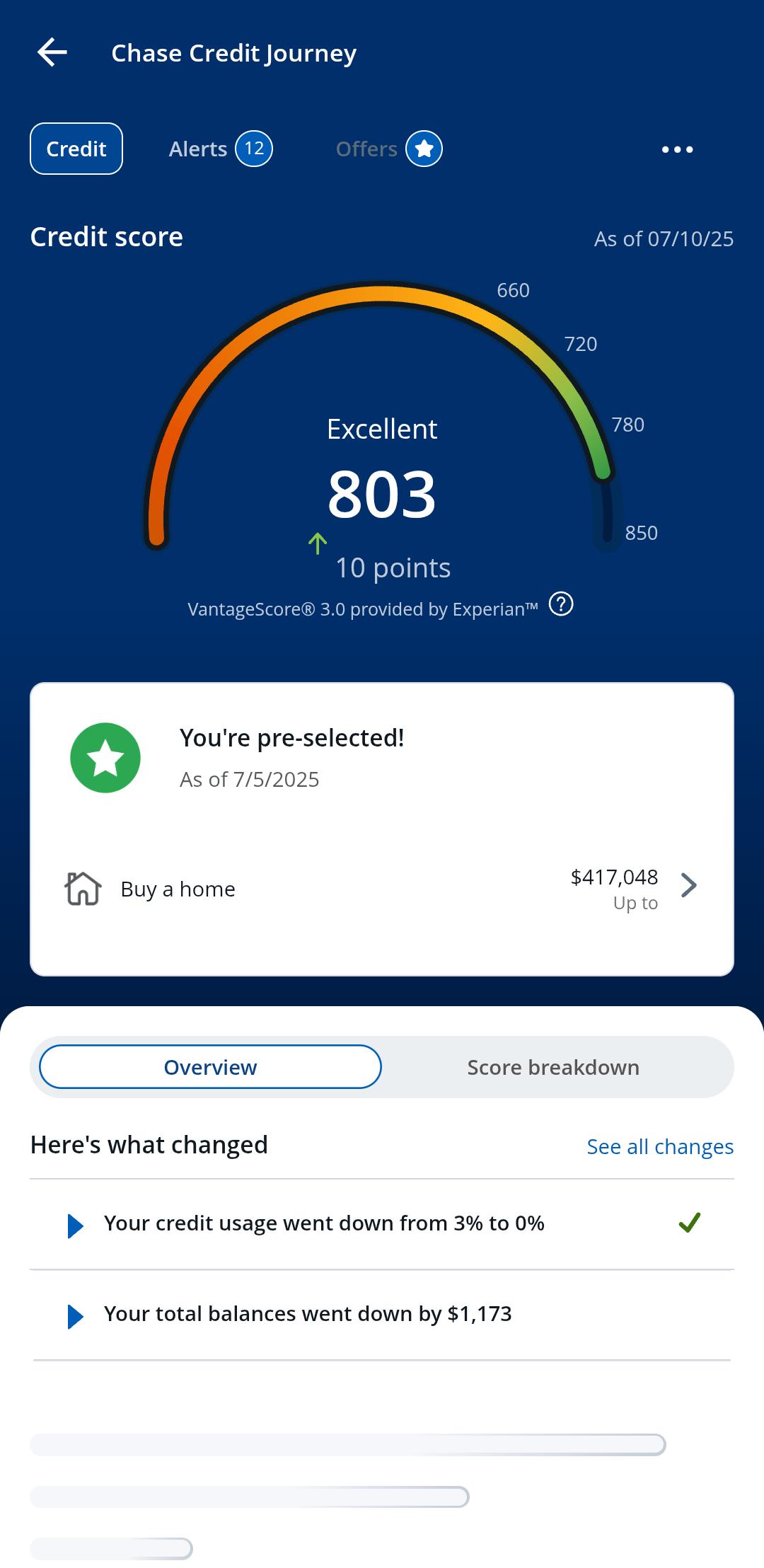

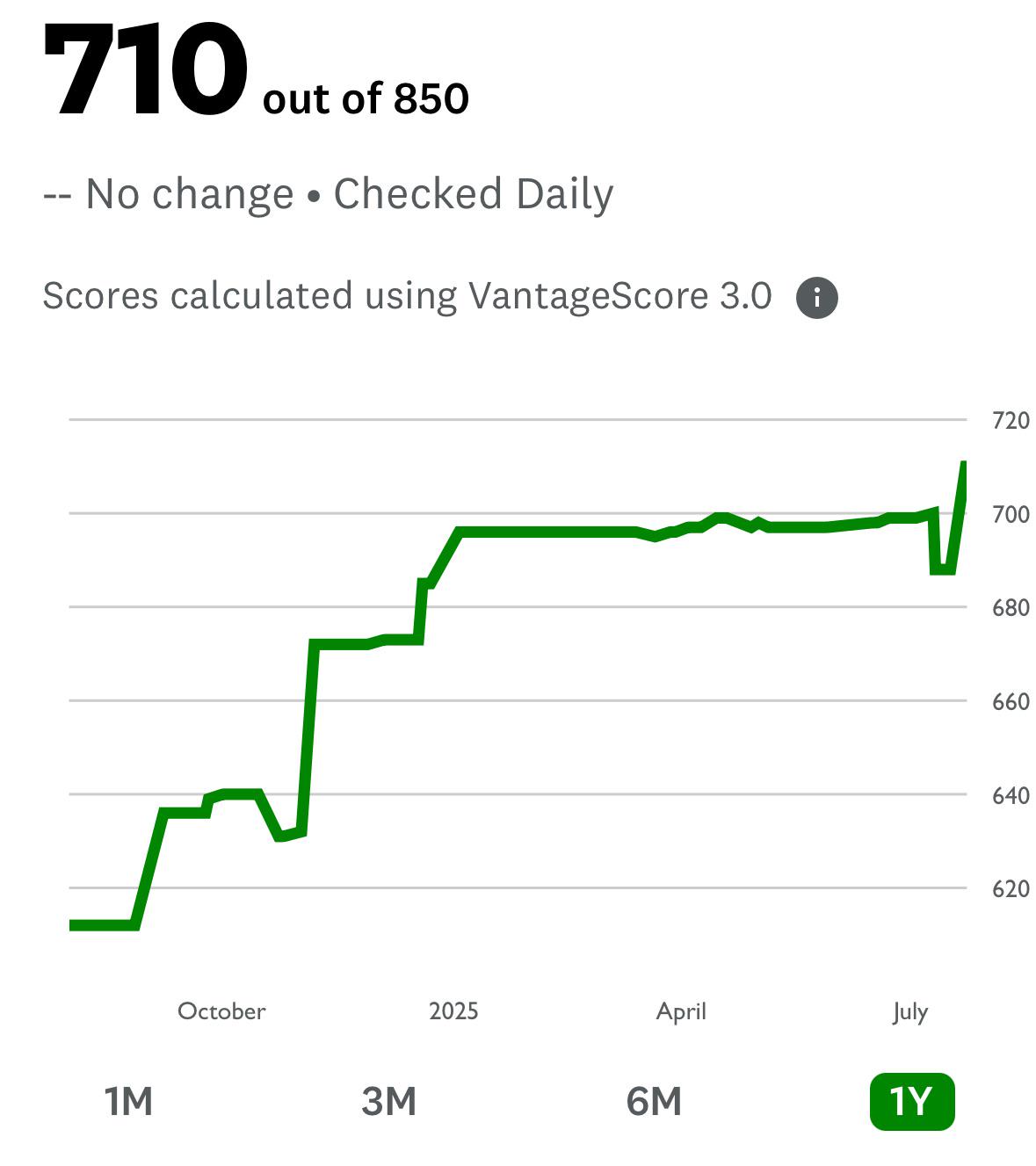

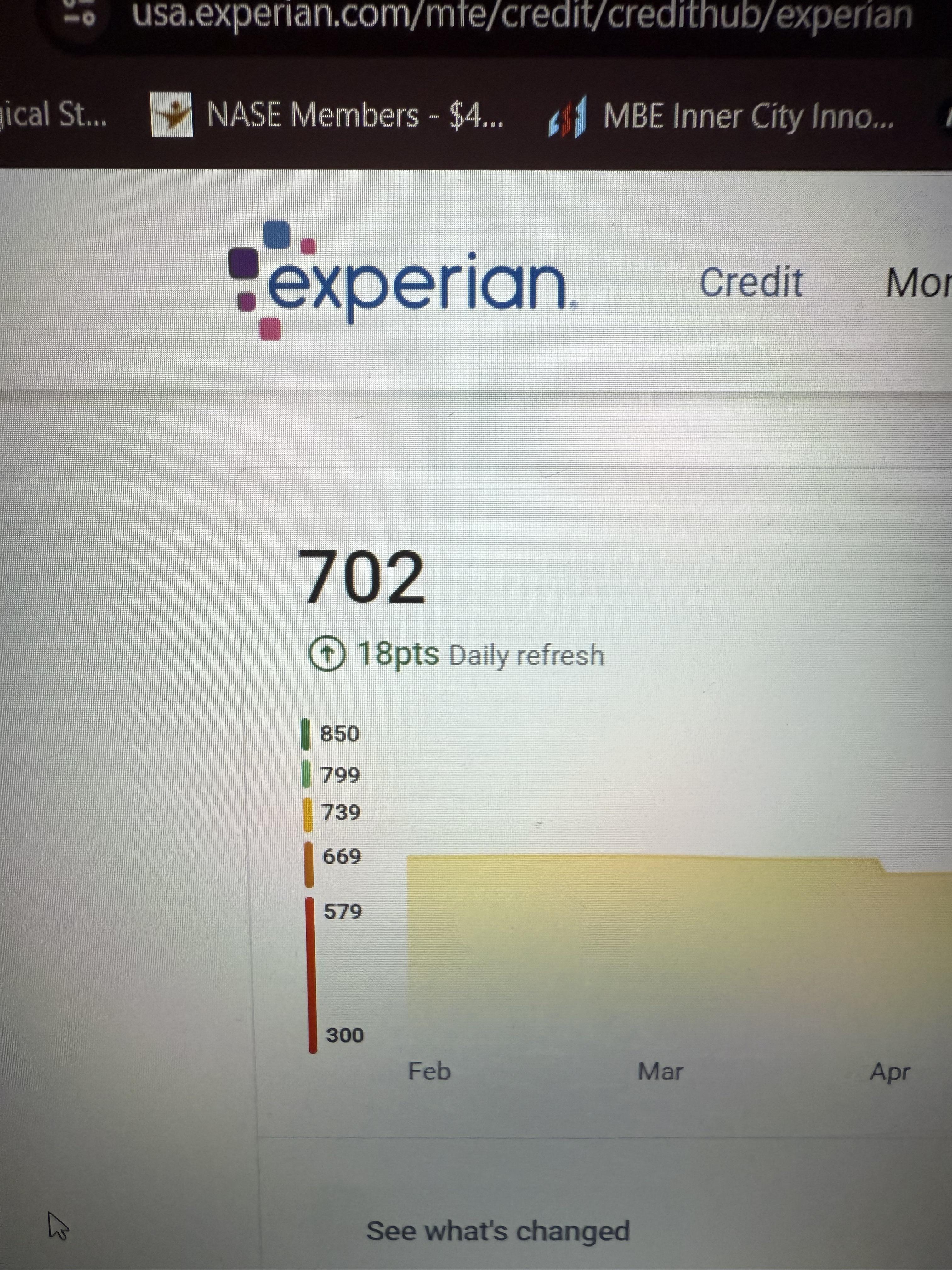

I had good credit before, never late on payments, no collections. I just couldn’t afford the amount monthly.

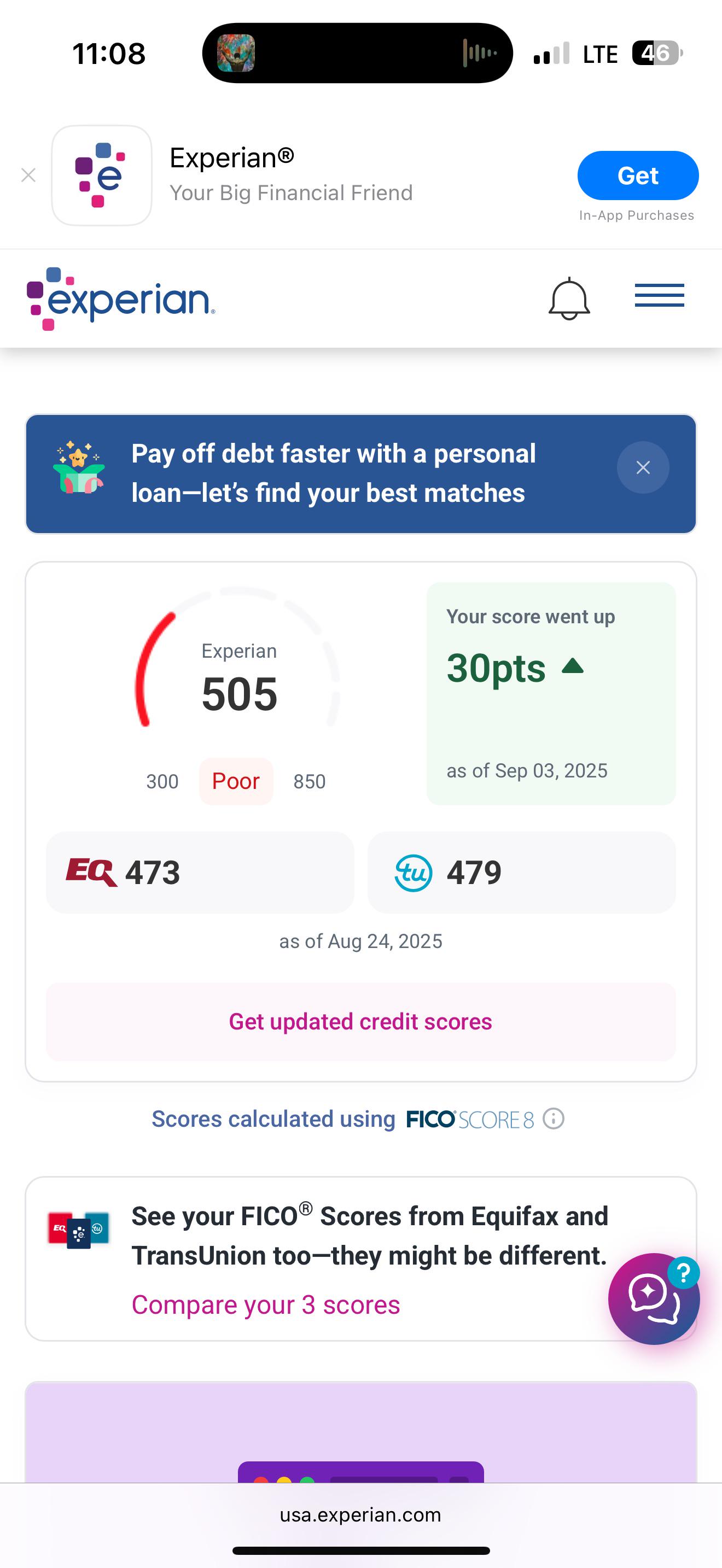

After signing up with FDR, I have one account in collections, one account that is still not closed. Rest are closed but still have balances.

I also co-signed on my ex’s car back in 2019, he recently stopped paying and lost the car. My credit took a big hit with that as well.

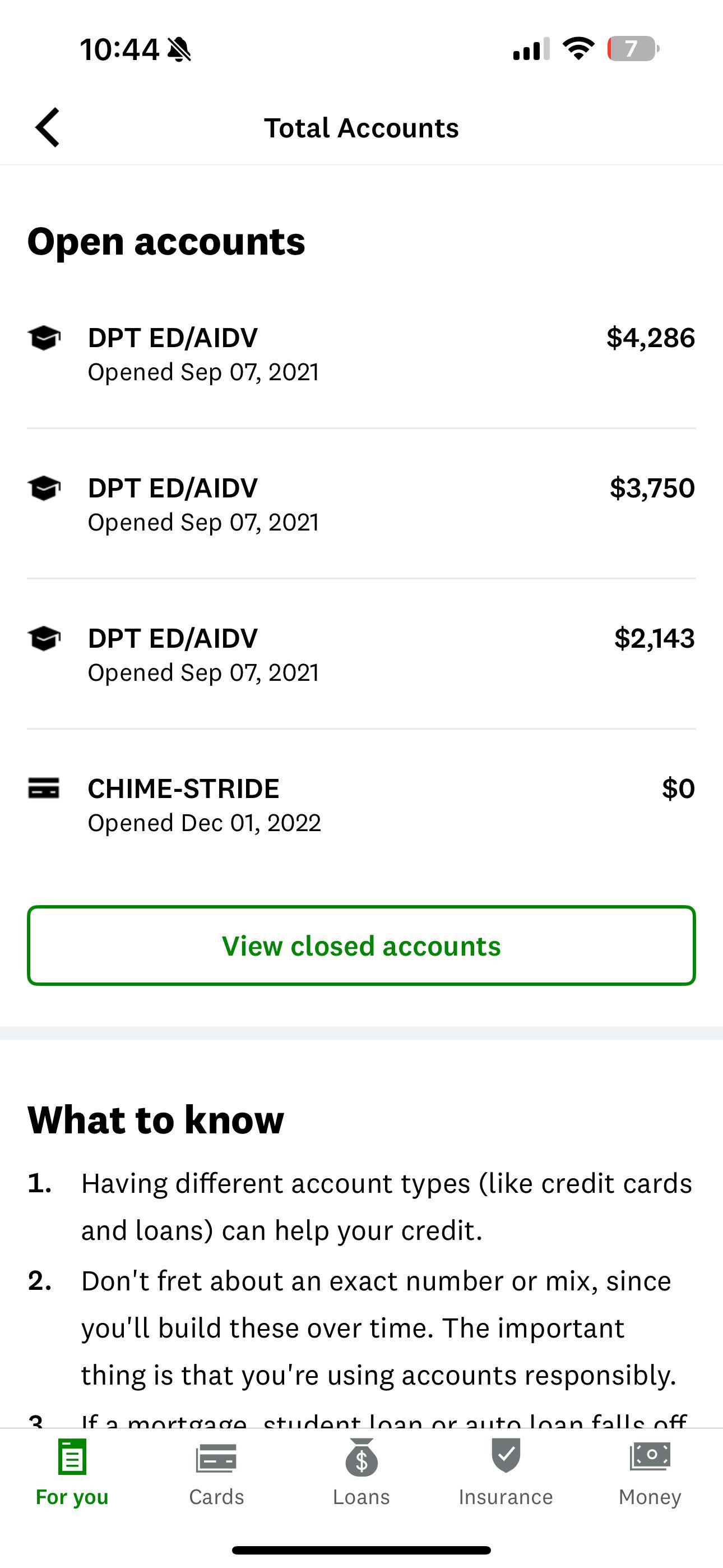

I have (in good standing) multiple debts:

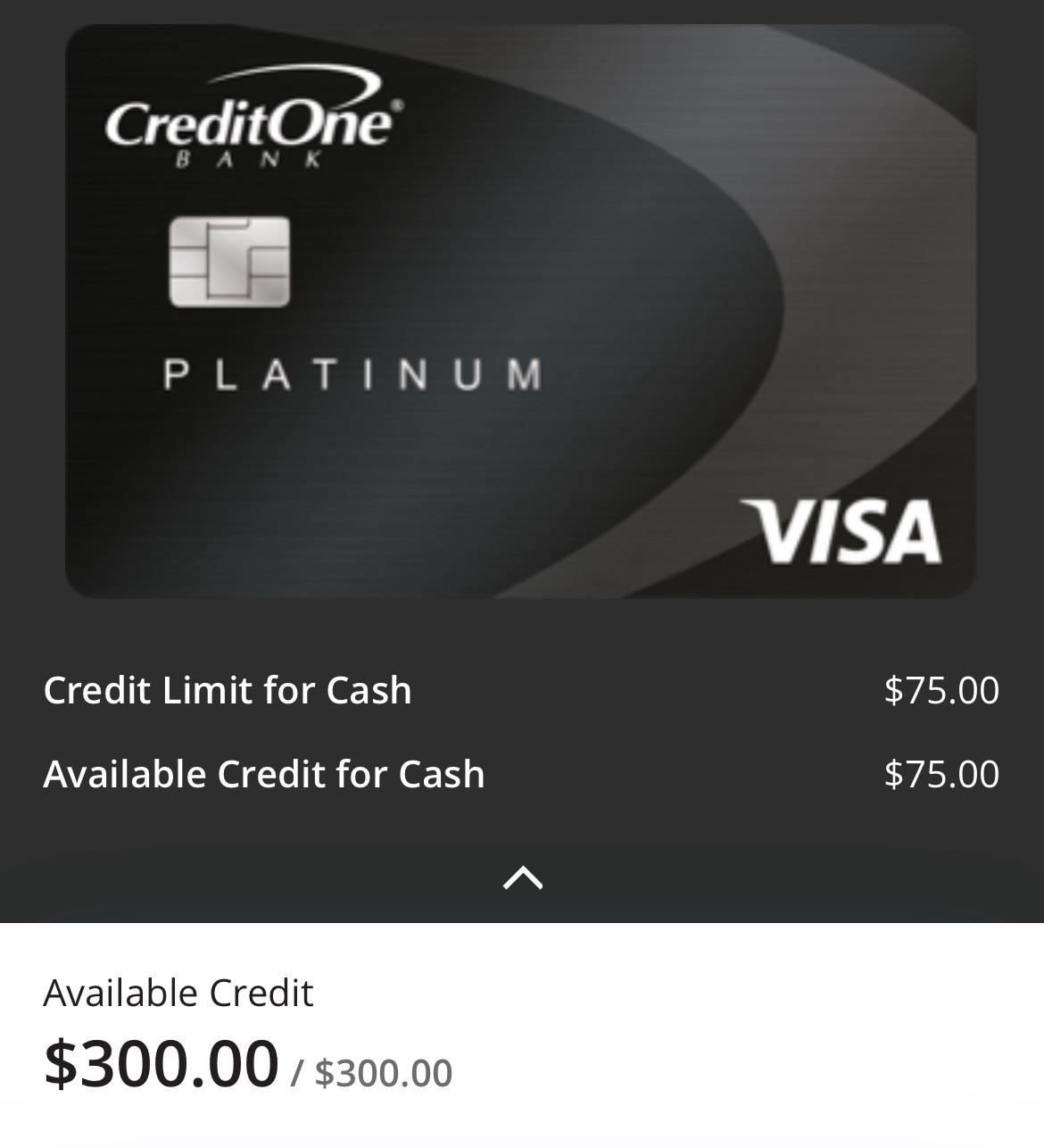

Secure CC $177.50

Auto Loan $16,350.77

Therapy bill $700

Medical bill $1,485.97

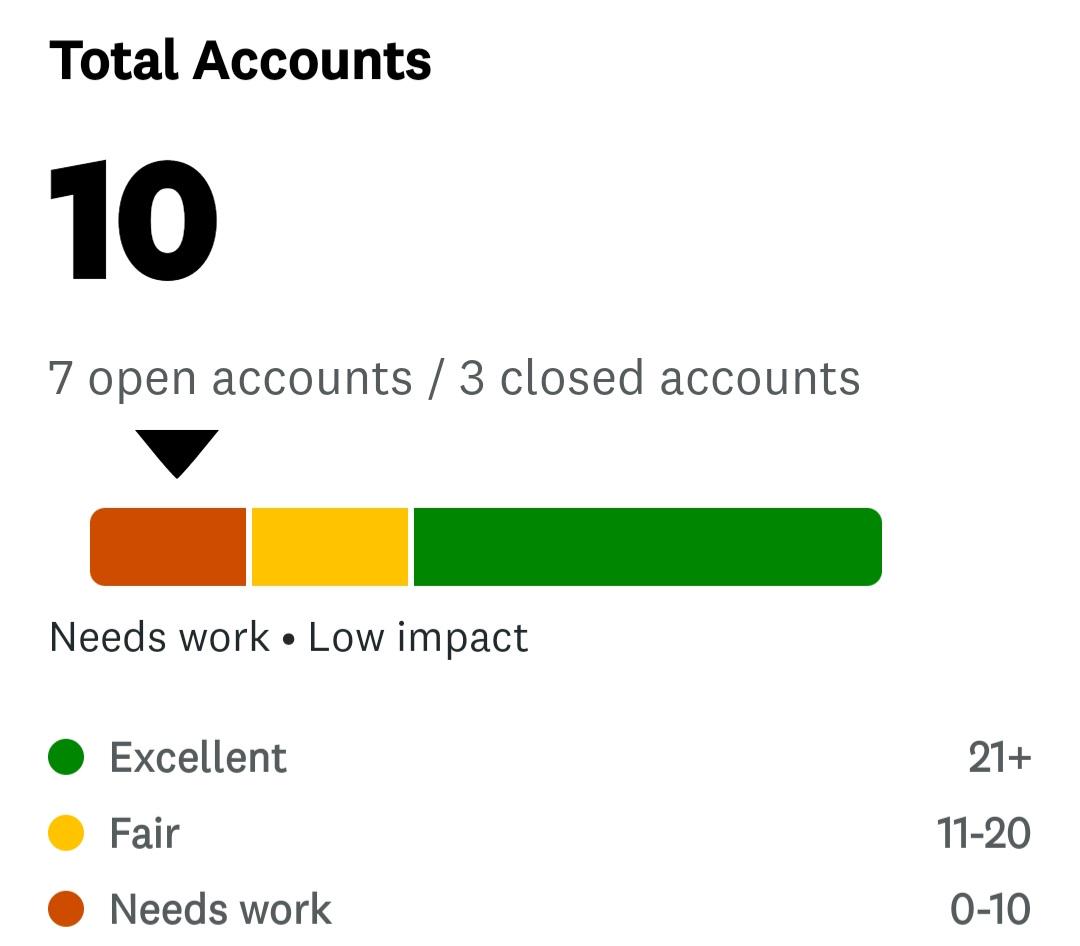

I do have a credit builder account that I recently started but it doesn’t seem worth keeping open.

How do I fix this? I need to get my life together so future me can buy a home someday.

Thank you for reading and any advice is greatly appreciated!!!!